“Now we enter mini bull phase → next target: $800,” one analyst speculated.

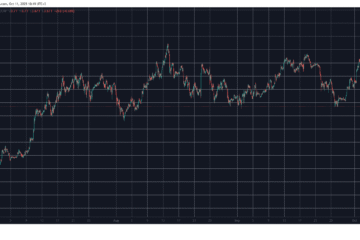

The rally of the popular privacy-focused cryptocurrency Zcash (ZEC) continues at full speed. It has skyrocketed by triple digits in a month or so, and the question now is whether this rally is just getting started.

How Much More?

ZEC started its upward move towards the end of September, when the price was hovering around $50. In the following weeks, its valuation was gradually climbing, and just a few hours ago, it reached a seven-year high of $370. Shortly after, ZEC registered a slight decline to the current $350 (per CoinGecko’s data), representing a staggering 520% increase on a monthly scale.

The token’s market capitalization, which stood below $1 billion last month, is now inching towards $6 billion. This makes ZEC the 35th-largest cryptocurrency, surpassing well-known altcoins such as Toncoin (TON), Cronos (CRO), Polkadot (DOT), Uniswap (UNI), and many others.

Despite the substantial increase, the coin’s price is still far below its all-time high of almost $1,900 witnessed in 2016. However, multiple analysts and traders believe the bull run might be just starting and envision a new record soon. X user JonnyJpegs predicted that ZEC could skyrocket to $2,356, seeing the next major resistance at $790.

“This is the roadmap to Zcash becoming a top 10 coin. The market is telling you that privacy matters,” they added.

BitBull argued that ZEC could now enter “a mini bull phase,” with the next target set at $800. They believe that if the price breaks the local resistance at $370 “with conviction,” this could spark a “mega bull” to $4,000.

Arthur Hayes – the co-founder of BitMEX and one of the most influential people in the crypto industry – also chipped in. Several hours ago, he made a “vibe check” on ZEC, highlighting its price explosion as of late and envisioning its potential to soar to $10,000.

It is important to note that such a pump would require the market capitalization to rise above $160 billion, which seems rather far-fetched (at least as of now).

You may also like:

The Possible Correction

Contrary to the optimism from the aforementioned figures, ZEC’s Relative Strength Index (RSI) suggests that the valuation may head south soon. The technical analysis tool is essential for traders, as it measures the magnitude and speed of recent price changes to give them an idea of potential reversal points.

It ranges from 0 to 100, and readings above 70 indicate the asset is in an overbought zone and may be poised for a short-term pullback. On the other hand, ratios below 30 are seen as buying opportunities. Currently, the RSI is set at almost 76.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!