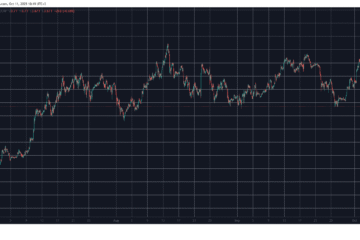

Bitcoin’s current price movement continues to raise questions about whether the bull cycle is coming to an end. However, accumulation patterns across different cohorts of BTC investors indicate the cycle is in late-stage maturity, not at a definitive end.

According to a report from CryptoQuant, on-chain data shows that although bitcoin’s short-term momentum is weakening, its long-term structural demand remains intact. This is substantiated by accumulation patterns in the dolphin cohort, the investor group comprising exchange-traded funds (ETFs), corporations, and large BTC holders.

Late-stage Maturity or Cycle End?

CryptoQuant analysts said the dolphin cohort is the anchor of this bull cycle and has become the most important group to monitor. These addresses hold a balance of 100 to 1,000 BTC and now account for the largest share of the circulating bitcoin supply (26%, or 5.16 million BTC). Their counterparts, including the whale, fish, and humback cohorts, account for just 21.32%, 21.57%, and 14.06% of the circulating BTC supply.

With the bulk of BTC holdings concentrated in this cohort, their behaviour can significantly affect market direction. Analysts found that growing accumulation from the dolphin cohort has aligned with upward price movement in the past. Contrarily, a slowdown preceded distribution or corrective phases.

In the current cycle, dolphins have been the primary accumulator, increasing their balances by more than 681,000 BTC in 2025. In contrast, their counterparts have recorded net declines in their holdings. This dynamic shows that institutions and large investors have been absorbing supply from smaller investors, sustaining a demand base for this cycle.

Dolphins Are Still Accumulating

As other investor cohorts reduce their holdings, the bull cycle increasingly depends on continued accumulation from dolphins. So, if the pace of dolphins’ accumulation slows, the market could move from an expansion to a consolidation phase.

The dolphin cohort’s annual growth needs to stay above its 365-day moving average for the bull cycle to maintain its uptrend. As it stands, dolphin holdings are rising at an annualized rate of 907,000 BTC, well above the 365-day moving average of 730,000 BTC. Unfortunately, the cohort’s 30-day balance growth has fallen below its 30-day moving average, signaling weakening demand. Analysts noted that the slowdown in balance growth coincides with bitcoin’s recent price correction from its all-time high above $126,000.

Nevertheless, the market structure suggests that demand from dolphins has not deteriorated; hence, the bull cycle may be in its later stages rather than at its conclusion. Bitcoin needs an accelerated monthly accumulation rate to push to new highs.

The post Bitcoin Accumulation Patterns Show Late-Stage Cycle Maturity, Not Definite End: CryptoQuant appeared first on CryptoPotato.