Bitcoin is once again struggling to find momentum after an aggressive drop a couple of weeks earlier. This current price behavior reflects hesitation from both bulls and bears, with traders closely watching to see whether BTC can hold its key support levels or if a deeper correction is coming. While the macro structure still leans bullish, short-term technicals are starting to show cracks.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, Bitcoin is hovering around a crucial intersection of the ascending trendline of the large channel and the 200-day moving average near $108K. The 200-day moving average is holding as dynamic support, but price has dropped below the 100-day MA, located around $114K, signaling fading bullish momentum.

The RSI remains weak around 40, and the series of lower highs since September’s all-time high confirms the short-term downtrend. If this current support zone breaks decisively, sellers could drag the price down toward the $100K critical level. On the other hand, to shift sentiment, the price needs to reclaim $114K with strong follow-through.

The 4-Hour Chart

Zooming into the 4H chart, Bitcoin is caught in a tight range between $108K and $116K, just above the rising trendline. This area has been tested multiple times, forming a short-term floor. However, each bounce is becoming weaker, suggesting buyer exhaustion.

RSI on this timeframe is flat, hovering in the mid-40s, showing a lack of directional conviction. If the price breaks below this trendline, expect a sharp move down to retest the key support zone around $100K. On the flip side, bouncing back above $110K with volume could shift momentum back toward the $114K–$116K supply zone.

On-Chain Analysis

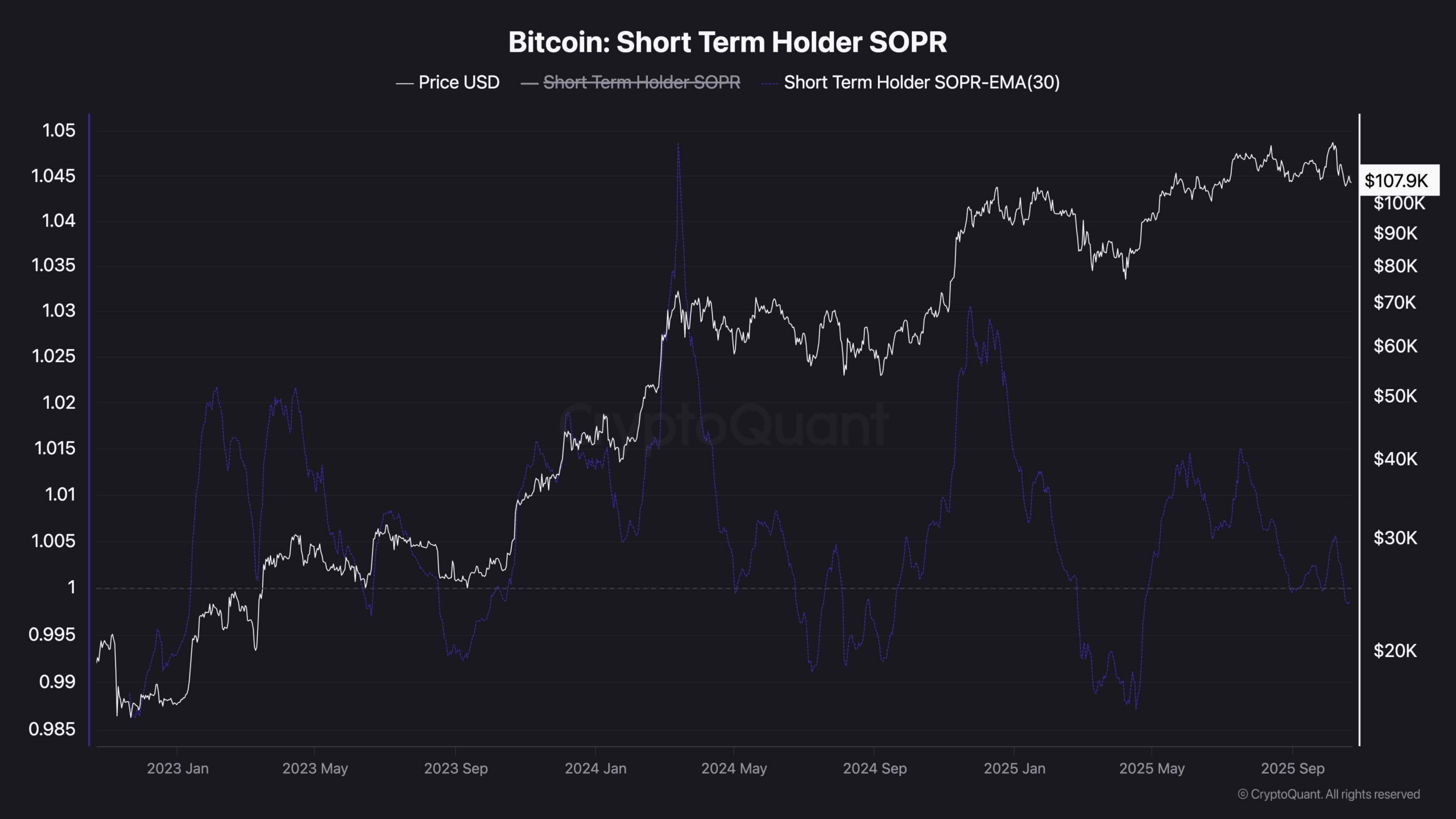

Short-Term Holder SOPR (30-Day Moving Average)

From an on-chain perspective, the Short-Term Holder SOPR has dropped below 1, indicating that some recent buyers are realizing losses. This typically signals a cautious market, as short-term holders are less likely to sell at a loss unless forced.

The recent SOPR peaks also show that profitability spikes have been consistently sold into, reflecting weak conviction during recent upswings. Until SOPR can reclaim and hold above 1, short-term rallies may continue to be met with distribution. This reinforces the importance of spot support zones, as they are now key battlegrounds between patient buyers and uncertain holders.

The post Bitcoin Price Analysis: Expectations for a drop to $100K Mount as Bulls Struggle to Regain Momentum appeared first on CryptoPotato.