The company now owns close to 641,000 BTC.

The world’s largest corporate holder of bitcoin continues to increase its stash by splashing another $43.4 million to acquire 390 BTC.

The latest acquisition comes amid reports of the company’s decreasing BTC purchases, at least for the past few months.

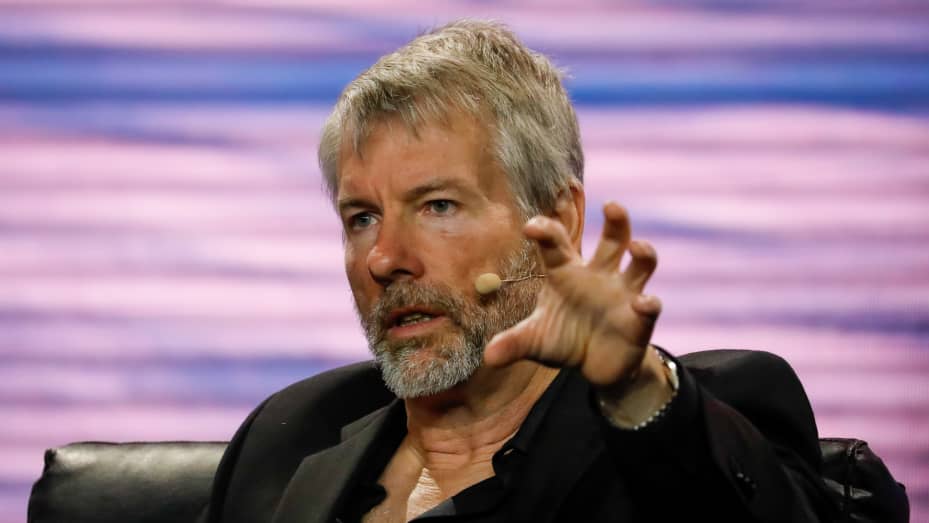

Strategy has acquired 390 BTC for ~$43.4 million at ~$111,053 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/26/2025, we hodl 640,808 $BTC acquired for ~$47.44 billion at ~$74,032 per bitcoin. $MSTR $STRC $STRK $STRF $STRD

— Michael Saylor (@saylor) October 27, 2025

Strategy’s new purchase was executed with an average bitcoin price of just over $111,000 per unit. As such, its total stash has risen to 640,808 BTC, bought for $47.44 billion (or an average price of $74,032 per BTC).

Given today’s price pump from the largest cryptocurrency and a current price tag of just over $115,000, this puts Strategy’s holdings at an unrealized profit of a healthy $26.3 billion.

It’s worth noting that the company’s latest BTC purchases have been rather modest compared to the end of 2024 and early 2025. CryptoQuant’s Maartunn dug deeper into this declining trend and outlined the possible reason behind it in this article.

Strategy’s stock prices have been in an evident downfall on a monthly scale, dropping from $360 to under $290 in October alone. MSTR is also slightly down YTD, losing 3.6% of value within this timeframe.

You may also like:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!