Binance Coin (BNB) has quietly outperformed Ethereum (ETH) year-to-date, not only in price but in maintaining a consistent structural impulse strong enough to define its own “BNB Season.”

While Ethereum’s momentum faded following the deleveraging phase, BNB’s impulse remained intact.

Fundamentals and Liquidity

On-chain data shared by Altcoin Vector supports this narrative. Despite active addresses plunging from over 1.6 million to around 800,000 on the BNB network during the deleveraging event, participation rebounded sharply to near previous highs amidst strong user engagement and sustained network health.

Similarly, BNB’s on-chain transfer volume also reflected continued liquidity surges, large-scale transactions, and ongoing ecosystem activity. Even as the so-called “BNB Meme Season” concluded before fully maturing, speculative activity on the BNB Chain continues to thrive. Meme tokens such as PALU, 币安人生, PUP, and 4 delivered dramatic returns, and minted hundreds of new millionaires, while some whales suffered steep losses amid FOMO-driven trades.

The speculative frenzy aside, Altcoin Vector explained that BNB’s current strength lies in several fundamental factors, such as liquidity and active user participation, with a maturing market structure. It added that when both fundamentals and narrative coincide, an asset often enters a sustained impulse phase; when narratives fade but fundamentals endure, it tends to consolidate.

In BNB’s case, its structure not only withstood the broader market’s collapse but has also laid the groundwork for what could be the next impulse cycle.

“BNB structure survived collapse. A potential new impulse phase is brewing. Not a speculative play, but a consistent tactical approach.”

Market Structure Signals Confidence

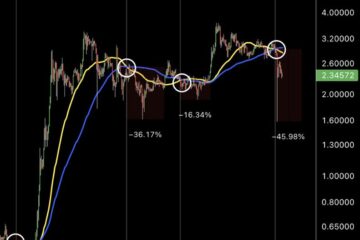

In terms of price trajectory, CryptoQuant found BNB has maintained its technical footing by holding above its 45-day moving average. Its latest price stands around $1,138, which is precisely aligned with its 45-day moving average, while the 90-day average trails at approximately $941. Despite a minor daily return of 2.7%, the overall setup indicates stabilization above a critical mid-term base. As such, longer averages, including the 60- and 90-day trendlines, remain upward sloping, which indicates continued momentum that was seen since early Q3.

Historically, each retest of the 45-day moving average has led to renewed upward moves for BNB, as shorter-term indicators such as the 7-day and 30-day averages recover first, followed by gradual increases in price and trading volume. The current formation is similar to past accumulation zones, where traders accumulated positions ahead of significant breakouts.

The convergence of short-term averages from the 7-day through the 45-day points to a period of compressed volatility. These conditions often precede decisive directional moves. Volume has also remained positive during recovery sessions, which means that buyers are actively defending key support zones.

The post While Ethereum Cools Off, BNB Keeps Its Heat: Data Points to Fresh Impulse Brewing appeared first on CryptoPotato.